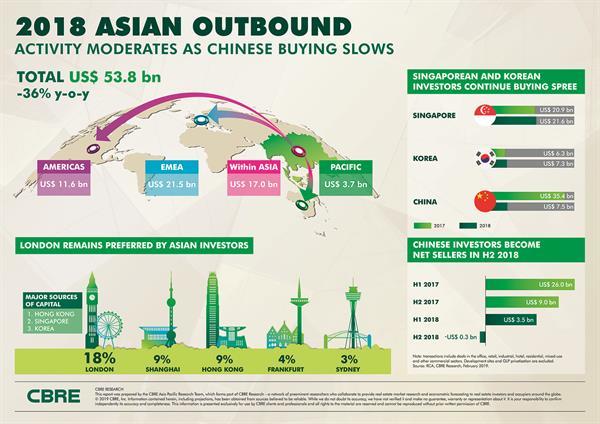

Asian outbound real estate investment noticeably moderated for the full year 2018, driven by primarily by a reallocation of portfolios by Chinese investors. Throughout 2018, a total of $53.8 billion (THB 1.72 trillion) in capital from Asia was allocated into offshore real estate by investors, according to CBRE, a decline of 36% year-on-year.

In 2018, Chinese investors rebalanced real estate portfolios, becoming net sellers of real estate in the second half of the year, contributing to the decline. Chinese investors deployed $7.5 billion (THB 239.1 billion) in capital into offshore real estate investments in 2018 versus $35.4 billion (THB 1.13 trillion) in 2017. According to CBRE’s 2018 Outbound Investment Survey, coupled with a decline in offshore investment, Chinese investors transitioned to net sellers to strengthen balance sheets and recycle capital for deployment into future outbound investments.

“The Asian outbound investment story in 2018 was on one hand characterized by a clear moderation from China but on the other hand, represented cyclical portfolio rebalancing and strategically preparation for future activity. The pullback from China’s investors was not entirely unexpected but encouragingly created opportunities for new strategic investors to amplify offshore investment activities,” said Leo Chung, Associate Director, Research, Asia Pacific CBRE.

Throughout 2018, Singaporean and Korean investors solidified their positions as more visible offshore real estate investors. Singapore-based investors deployed a total of $21.6 billion (THB 688.6 billion) in 2018 against $20.9 billion (THB 666.3 billion) in 2017. Korean investors allocated $7.3 billion (THB 232.7 billion) in capital last year versus $6.3 billion (THB 200.8 billion) in 2017. Investors from Malaysia and India also became more prominent in 2018, selectively investing more capital overseas, up 132% and 291% respectively.

Geographically, allocations remained consistent year-on-year, in terms of percentage of annual capital deployed. EMEA remained the leading destination for Asian outbound capital in 2018. The region attracted $21.5 billion (THB 685.4 billion) in total capital from Asian investors in 2018. Intra-Asian investments finished 2018 at $17 billion (THB 542 billion), followed by the Americas at $11.6 billion (THB 369.8 billion) and Pacific at $3.7 billion (THB 118 billion).

London remained the top destination for Asian capital, owing to strong fundamentals and its established standing as the preferred metropolitan areas for first time buyers to invest. Investors from Hong Kong, Singapore and Korea were the major buyers, accounting for over 85% of the investment activities. In 2018, 18% of total Asian outbound capital was deployed to London, up from 13% in 2017. The appetite for gateway cities was also reflected in Hong Kong (9%), Shanghai (9%) and Frankfurt (4%), growing or maintaining their percentage of total investment deployed for 2018.

“Asia-based investors remain hungry for offshore acquisitions, but will employ a more selective strategy in their overseas purchase activities. The hedging costs into certain countries are also impacting investment flows for many outbound Asian investors,” said Tom Moffat, Head of Capital Markets, Asia, CBRE.