The holding company of Kokotel, Newlegacy Hospitality Pte. Ltd. in Singapore has received investment from the strategic investor, Relo Group, Inc., through its subsidiary, World Resort Operation, Inc. (WRO).

The investment has been structured through the new issue of a minority percentage of shares of Newlegacy Hospitality. In consequence, the largest of the existing shareholders, REAPRA, remains a significant major shareholder in Newlegacy Hospitality. It is anticipated that this initial investment will be the first in a series, with Relo granted the option to make further investments if the new business partnership proves beneficial. Kokotel, meanwhile, has stated its intention to utilize the proceeds of the investment in achieving the further expansion of its business operations.

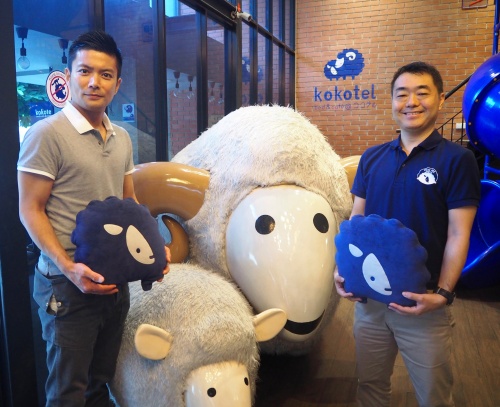

Kokotel CEO Rei Matsuda explained the significance of Relo Group’s investment. “As a Japanese business person, I have always had the strongest respect for Relo Group for its spirit of entrepreneurship and the massive growth of its business in the last few decades,” he said. “In my opinion, Relo is a great example of a Japanese corporate that has grown so rapidly with a mindset to serve its clients by solving problems. Since our business is to solve problems of hotel owners for that ‘Wow’ business return and emotional return, I feel there will be a strong positive impact from the DNA of Relo Group.”

Relo Group is a listed Japanese company with a market cap exceeding JPY 350 billion (USD 3.3 billion). Its business interests lie in the outsourcing of non-core operations of clients, in addition to leased corporate housing management, residential property management, and fringe benefit. The company has recorded sales growth for nineteen consecutive years, and has achieved record profits in each of the past ten years.

Relo’s investment is to be made through its subsidiary, World Resort Operation, Inc., which specializes in hotel investments and operations. The company currently operates or provides consultancy services for 29 properties in Japan, having been in the business for the past decade. It is likely that a number of benefits will accrue to both parties as a result of WRO’s investment in Kokotel.

WRO has a substantial customer database and long experience with Japanese OTAs through which it will be able to support Kokotel properties in Thailand by sending Japanese guests. WRO also has the intention of collaborating with Kokotel to establish properties in Japan under the Kokotel brand, as well as making investments in Thai hotels and properties across other parts of Southeast Asia which Kokotel will operate. The two companies will also be able to exchange staff for training purposes, with WRO sharing expertise in hotel operations, revenue management, and property KPI management, thus strengthening Kokotel in terms of operational capabilities.

“We share the same principle to operate many small-scale hotels by taking advantage of ‘centralized operation’ at HQ,” explained Rei. “While WRO has a longer history, more properties, and more sophisticated work processes, there will be a lot of capabilities and expertise to learn and absorb from them. By taking advantage of WRO’s unique strength of operating hotels in Japan, I expect many new businesses will happen as a result of this new partnership.”A spokesperson for Relo added that “while the businesses of the two companies are quite similar, Kokotel has interesting strengths, its unique brand and strong presence in Southeast Asia, which are different from WRO. WRO would like to work with Kokotel as a stepping stone for its further overseas business expansion.”